Investor's Criteria

At Northern Property4u, we know for fact that the right LOCATION and a strict Property T.A.R.G.E.T CRITERIA are fundamental factors but not enough to guarantee a successful property investment, a property investor also needs to access his own specific criteria according to his situation, budget and goals.

For Investors:

Investment Criteria Checklist

1 / Choose your location carefully

As a dedicated sourcing company, we offer our sourcing services in the most lucrative regions in the north of England, we cover specific postcodes in Liverpool, Manchester, Leeds, Warrington, and few other limited locations.

We encourage our investors to choose the city or town from our sourcing area list and our expert team will be at your service, advise, guide and work with you and find the best property according to your situation, budget and needs.

Our property sourcing detectives will search carefully your chosen area, investigate the neighborhood, do all the property due diligence, market research of the area, transport links, amenities, local stores, hospital, schools, tenant type, a FULL REPORT WILL BE PRODUCED BY OUR SOURCING TEAM FOR YOU.

Go deep with your location research and check out the data for yields, house price growth, buyer demand, tenant demand. Make sure that you know not only the value of your property but also the property street value compared with other properties on the same street. As a general Rule : We don’t plan selling our investment properties more than the highest street value.

2/ Choose only properties with achievable discount

Following the golden Rule: Making profit is when buying a property, not when selling it.

You must lock your profit from day one - from the sale price. Buying discounted, below market value properties is the first step of your successful property investment. No property investor checklist is complete without considering the price of your purchase.

To secure best property deals, investors are advised to work only with motivated sellers. Sellers that have a 'need' to sell, not just 'want' to sell. Also you should consider all refurbishment costs. Whether you are buying one property or building a portfolio. Overpaying by even a small amount can significantly impact your return on investment.

3 / Choosing your investment Strategy:

Choosing the right investment strategy, according to your situation, budget and goals, will have a major impact on the success of your investment . The Northern Hotspots offers a wide range of assets and below market properties with various investment strategies, tailored and customised to investors of all levels of experience, budgets, and goals.

Get in touch with our friendly team and we advise you about the most suitable strategy for you according to your situation.

Understanding what is happening in the current property market and knowing your investment local area is key to choosing the best investment strategy . For example, for Buy to let, You should invest in areas populated by family type tenants, not populated by university students which will suit a HMO Strategy.

Choosing a Service Accommodation strategy in isolated areas or a busy buy to let area which none of them is compatible with the SA Strategy which require high end customers as business people, temporary traders, occasional visitors.

Flipping properties can be a risk if house prices drop in the short period when you have work completed, so choosing an area with a history of good capital growth appreciation and having an exit strategy is the best strategy to think of and follow. Also, not forgetting to consider the current interest rates which is essential in deciding what investment strategy to choose. Choosing a fixed term interest rate for 3 or 5 years will give you the peace of mind to flip your property in good plenty-time.

3 / Define Your Tenant type Target Market

Create a tenant persona that defines who will choose to live in your property and what they want from a rental home.

Consider the type of tenants who would be looking to rent properties in this area. Is the location a better fit for local housing allowance tenants, students, working professionals or corporate short term stays.

Some locations and properties are also better-suited tenancies to individuals, couples and families. Whilst others are best for multi-let (also known as houses of multiple occupation).

As a guide, most property investors aim to achieve a minimum of 8%+ gross rental yield for a single let and 12%+ gross rental yield for a house of multiple occupation. When considering buying a holiday let or serviced accommodation, yields real vary as occupancy levels can fluctuate widely from cities to seaside resorts. A gross rental yield of 20%+ for a holiday let can be a good target.

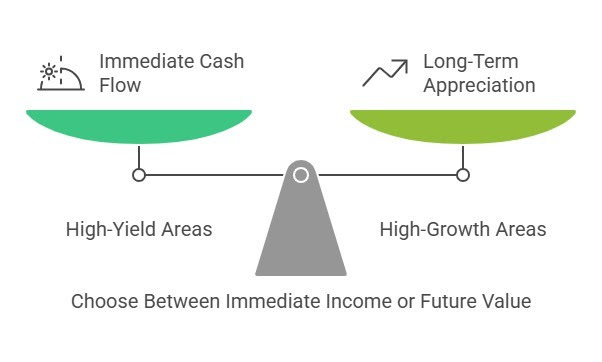

4 / Choose Long Term Capital Growth or Instant Monthly Rental Payment Or Both ?

Sometimes location can offer investors a mixture of profit between constant monthly cash flow coming from the rent, in addition to the capital growth appreciation, but not all properties and locations can offer these dual benefits.

Sometimes location can offer investors a mixture of profit between constant monthly cash flow coming from the rent, in addition to the capital growth appreciation, but not all properties and locations can offer these dual benefits.

Some areas can enjoy a high rental yield with a slow or insignificant capital growth and some locations can offer a good long term capital growth but it comes with very little rental yield.

So it is important as an investor to define your investment criteria and know what you are exactly looking for, capital growth, high rental yield, or both, then find the right location to match your property criteria.

Some areas offer only properties with good capital appreciation and poor rental yiels and othersare the opposite, offering a high yiels with no capital appeciation for years andsome areas offer both at thesame time, good yiels and capital growth.

5. Exit Strategy

This is one thing many property investors and even property developers get wrong. They think about the exit plan too late. A key tip is to think about your exit, at the beginning of your property search. Before you even view or purchase your property investment.

Make sure to have a plan A & B for your property exit strategy. In case your circumstances change.

6. Potential To Add Value

A property that's ready to let out straight away can save you a significant amount of time. However, a property where you can add value with even a small refurbishment could significantly increase your return on investment.

Think about what is best for your budget and your personal goals, to help define your strategy.

7 Consider Finances and Taxation

Another huge consideration is financing and tax. In other words – how you fund your investment and how it’s likely to be taxed.

Getting a buy-to-let mortgage: If you don’t have the cash to buy your investment property outright, you will need to take out a buy-to-let mortgage. That’s because a typical residential mortgage won’t be suitable. You will need to demonstrate that your investment is sound and will bring in enough rent to cover the mortgage payments – possibly around 145% of the monthly cost of your loan. You must also provide a larger deposit – usually between 20-40%.

Considering other costs & schemes: It’s essential to weigh up all of the costs that will come with your purchases, including stamp duty. If you own a property, you must pay the 3% surcharge. However, it is worth researching any grants or loans that may help you fund the purchase or renovate the property if needed – the government’s Green Homes Grant scheme, for example.

Weigh up taxation carefully: Your tax obligations will also be a key consideration before deciding whether to invest in property and which type of investment will be the most profitable option. You must pay tax on your rental income and calculate this and pay HMRC through a self-assessment each year. The tax obligations will vary depending on whether you run the property business as a full-time job, what other income you have and how much money you have in savings accounts.

8/ Due Diligence & Risk Assessement

Understanding and managing risks is essential to safeguarding your real estate investment and maximizing returns. Risk assessment is a crucial step in the due diligence process, as it helps identify potential challenges and uncertainties that may impact a project's success.

Our Sourcing services cover the following strategies :

We specialise in Sourcing Buy-To-Lets Turn Key Properties so that you can build a portfolio completely hands FREE.

Flipping Houses:

We Source Top properties for Buy to Sell-Flip Projects for QUICK & MASSIVE investment Returns.

We find you a Below Market Value properties To Refurbish for quick sale Or Convert from 2 to 3 bedrooms house Or 3 to 4 Bedroom House, adding a value of 100k for each conversion that cost less than 30K, MAKING You an average net profit of 30K to 50K for each conversion project depending on the property size and its value.

SPECIFICALLY,

We can Source for you Lucrative (BRR) Buy Refurbished Refinance projects /Or Profitable (HMO'S) Projects in high rental demand areas.

STAY IN TOUCH

At our property sourcing company in Warrington, we're passionate about investment properties and will always be here to help. Contact us anytime for questions or just to catch up!

BOOK A CALL WITH EXPERT